Zipbooks

Cloud accounting and bookkeeping software designed for small businesses, freelancers, and agencies to manage invoices, payments, expenses, bank reconciliation, and financial reports in one web app.

What is ZipBooks

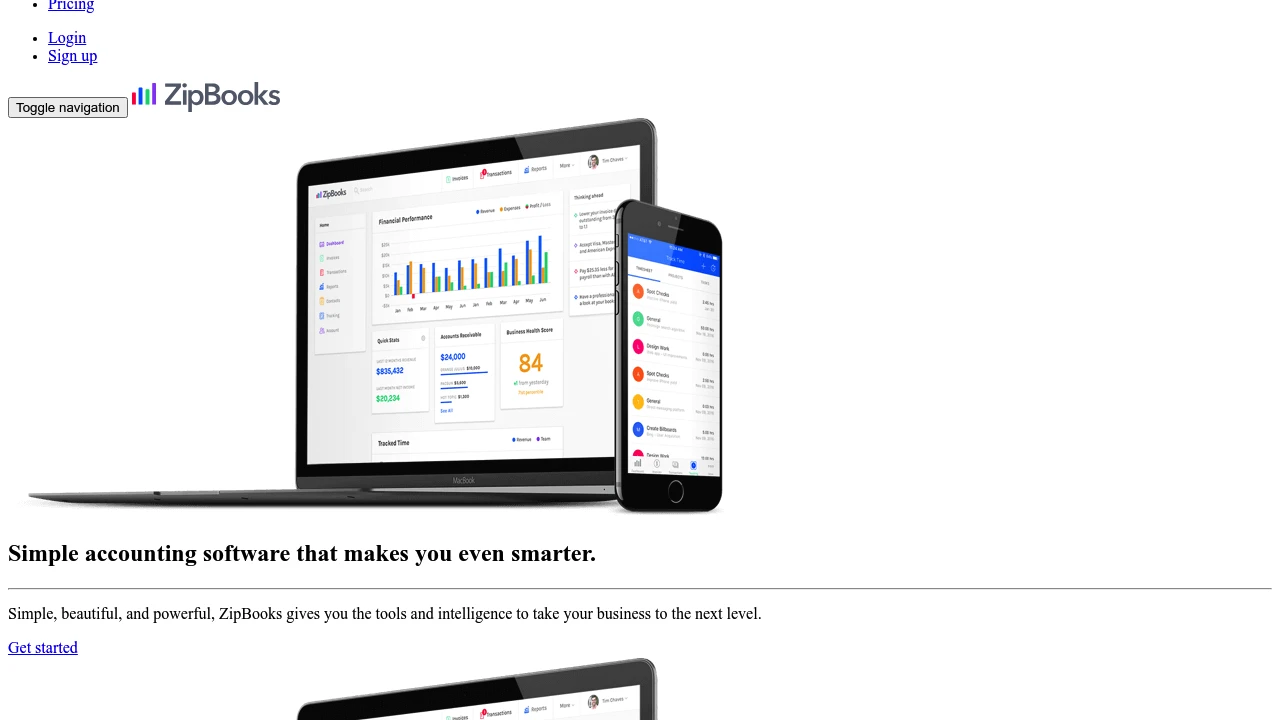

ZipBooks is cloud-based accounting software for small businesses, freelancers, and service providers. It combines core bookkeeping functions—invoice creation, expense tracking, bank reconciliation, payment processing, time tracking, and basic financial reporting—into a single web application accessible from desktop and mobile browsers. The product is aimed at teams and solopreneurs who need professional bookkeeping features without enterprise complexity.

ZipBooks supports basic double-entry accounting workflows while keeping the user interface simple for non-accountants. It includes built-in templates for invoices and estimates, tax settings for common jurisdictions, and automated reminders for unpaid invoices. The platform also integrates with payment processors so businesses can accept card and ACH payments directly from invoices.

ZipBooks positions itself between entry-level free bookkeeping tools and full-featured accounting suites by providing managed bookkeeping-friendly features — such as real-time bank feeds and categorized transactions — with a clean user experience and straightforward reporting tools.

ZipBooks features

ZipBooks provides a range of bookkeeping and financial management features designed for small teams and independent professionals. Below are core functional areas and notable capabilities:

- Banking and reconciliation: automatic bank feeds, transaction matching, and bulk reconciliation tools to keep accounts current.

- Invoicing and payments: customizable invoice templates, recurring invoices, automatic payment reminders, and integrated payment processing to collect card and ACH payments.

- Expense tracking: receipt capture, vendor/expense categorization, and expense approval workflows for multi-user accounts.

- Time tracking and project billing: track billable hours, attach time entries to invoices, and manage projects with budgets and profitability tracking.

- Reporting and dashboards: profit & loss, balance sheet, cash flow, customer statements, and simple visual dashboards for quick financial insights.

- Multi-user roles and permissions: control access for staff, contractors, and external accountants.

- Integrations and extensions: built-in connectors for major payment processors, payroll providers, and third-party productivity tools.

What does ZipBooks do?

ZipBooks simplifies day-to-day bookkeeping tasks so businesses can maintain accurate financial records and get paid faster. It automates transaction import from bank and credit card accounts, suggests categorizations based on rules, and provides reconciliation workflows to verify balances. That reduces manual data entry and speeds monthly close procedures.

On the revenue side, ZipBooks provides invoice creation with customizable templates, automated follow-up reminders, and integrated payment acceptance so customers can pay invoices online. Businesses can set up recurring invoices for subscriptions or retainer arrangements and track invoice status from draft to paid.

For reporting, ZipBooks generates standard financial statements and has dashboard views to surface overdue invoices, cash position, and project profitability. The platform also supports exporting data to CSV and common accounting formats for use by external accountants or tax professionals.

ZipBooks pricing

ZipBooks offers these pricing plans:

- Free Plan: $0/month with basic invoicing, simple reporting, and limited integrations

- Starter: $15/month with automated bank feeds, recurring invoices, and basic payment processing fees included

- Professional: $35/month with advanced reporting, time tracking, project profitability, and priority support

- Enterprise: Custom pricing for high-volume or multi-entity businesses with dedicated onboarding and advanced permissions

Check ZipBooks' current pricing tiers for the latest rates, annual billing discounts, and enterprise options.

How much is ZipBooks per month

ZipBooks starts at $0/month for the Free Plan. Paid plans commonly begin around $15/month for small-business feature sets and move up to roughly $35/month for more advanced accounting, time tracking, and reporting features. Enterprise plans are quoted per customer based on volume and support needs.

Monthly billing is available for businesses that prefer month-to-month flexibility; annual billing often reduces the effective monthly cost by roughly 10–20% depending on promotions and current offers.

How much is ZipBooks per year

ZipBooks costs about $180/year for the Starter plan (billed annually at the equivalent of $15/month). For the Professional plan, annual billing commonly totals about $420/year at the equivalent of $35/month. Enterprise customers receive an annual quote based on required services and onboarding scope.

Annual billing is typically offered at a discount versus monthly billing and is useful for organizations that want to stabilize expenses and minimize administrative changes during the fiscal year.

How much is ZipBooks in general

ZipBooks pricing ranges from $0 (free) to custom enterprise pricing. For most small- and medium-sized businesses, expect a range of $0 to $35/month depending on required features like automated bank reconciliation, time tracking, multi-user access, and advanced reporting. High-volume or multi-entity customers should plan for a higher, custom quote under the Enterprise plan.

Businesses should compare feature needs (for example, payroll integration or advanced permissions) when estimating monthly or yearly costs, because add-on services and payment processing fees can affect the effective price.

What is ZipBooks used for

Small businesses and freelancers use ZipBooks for day-to-day bookkeeping and invoicing. Common use cases include creating and sending invoices, tracking payments and overdue accounts, reconciling bank transactions, and running monthly financial statements. The interface is tuned for users without an accounting degree, making it suitable for service providers, consultants, agencies, and small retailers.

Teams use ZipBooks to coordinate billing and expenses. Multi-user access, role-based permissions, and expense approval workflows let businesses separate duties between owners, employees, and accountants. Project and time tracking features help firms that bill by the hour or want to analyze project profitability.

Accountants and bookkeepers use ZipBooks for client bookkeeping. The platform’s export formats, audit-friendly transaction histories, and multi-entity support make it useful for managing several small clients, performing month-end close tasks, and preparing files for tax filing.

Pros and cons of ZipBooks

ZipBooks offers a simple, approachable accounting experience with features that address the core needs of small businesses, but there are trade-offs to consider.

Advantages:

- Clean interface and quick setup reduce onboarding time for non-accountants and sole proprietors

- Built-in invoicing with payment acceptance reduces time-to-pay for invoices

- Free tier provides usable functionality for very small operations or trial purposes

- Project and time tracking features suitable for professional services

Disadvantages:

- Advanced accounting features found in larger suites (for example, full payroll, complex inventory, or multi-currency in some tiers) may be limited or require third-party integrations

- Enterprises and high-volume users may need a custom plan or move to a more robust ERP/accounting platform

- Integration ecosystem is smaller than major competitors, which can require manual exports for some workflows

Operational considerations:

- Businesses that anticipate rapid scale should evaluate integration and API capabilities early to avoid switching costs later

- Organizations with complex tax needs or inventory-heavy operations should map required workflows against ZipBooks’ feature set during a trial period

- Payment processing fees are separate and vary by processor; include those when comparing tools

ZipBooks free trial

ZipBooks commonly offers a free tier and may provide time-limited free trials of paid features for evaluation. The Free Plan lets users test core invoicing and basic bookkeeping without entering payment details, which is useful for assessing UI, basic workflows, and reporting capabilities.

Paid plan trials (when available) usually unlock automated bank connections, recurring invoices, time tracking, and advanced reports so finance teams can evaluate month-end close time, bank reconciliation automation, and invoicing workflows under real load. Trial periods let businesses confirm integrations with their bank and payment processor before committing to a subscription.

Before starting a trial, prepare sample invoices, a representative bank CSV, and typical expense receipts so you can test reconciliation, categorization rules, and reporting. If integration with payroll or third-party tools is important, validate those connections during the trial as well.

Is ZipBooks free

Yes, ZipBooks offers a Free Plan that includes basic invoicing, basic reporting, and limited integrations suitable for freelancers and very small businesses. The free tier typically supports a single user and provides core capabilities like invoice generation, simple expense tracking, and manual transaction import.

Free-tier users who need automated bank feeds, time tracking, advanced reporting, or multi-user permissions will generally upgrade to a paid plan. Payment processing and some add-on services may still incur transaction fees even on paid plans.

ZipBooks API

ZipBooks provides an API and developer-focused endpoints for programmatic access to invoices, customers, transactions, and reports. The API supports common RESTful patterns, allowing developers to create, read, update, and delete core resources so accounting data can be synchronized with external systems such as CRMs, e-commerce platforms, and custom dashboards.

Typical API capabilities include:

- Invoice creation and retrieval for automated billing workflows

- Customer and vendor contact synchronization

- Transaction and bank feed ingestion for automated reconciliation

- Time entry and project data push/pull for billing and payroll integration

- Report generation endpoints for scheduled financial exports

Authentication is usually handled with API tokens or OAuth2 depending on the integration type. Developers can use webhooks where supported to receive real-time notifications for events like invoice payments, new receipts, or reconciled transactions. For implementation details consult ZipBooks’ official developer documentation and API reference pages.

View ZipBooks’ API documentation and integration resources for full endpoint lists, authentication flows, and code examples.

10 ZipBooks alternatives

Paid alternatives to ZipBooks

- QuickBooks Online — Full-featured accounting for small to mid-size businesses with payroll, inventory, and deep third-party integrations; higher learning curve but robust feature set.

- Xero — Cloud accounting with strong bank reconciliation, multi-currency support, and a large app ecosystem for international businesses.

- FreshBooks — Invoicing-first accounting tailored to freelancers and small service businesses, with simplified time tracking and client billing.

- Wave — Free core accounting and invoicing aimed at microbusinesses; paid add-ons for payments and payroll.

- Sage Business Cloud Accounting — Enterprise-capable features for growing companies, including inventory control and advanced financial reporting.

Open source alternatives to ZipBooks

- Odoo — Open source ERP with accounting modules; flexible and extensible but requires hosting and configuration effort.

- ERPNext — Open source ERP with integrated accounting, inventory, and project management suitable for small businesses that want self-hosted control.

- Dolibarr — Modular open source ERP/CRM with core accounting features; suitable for small organizations comfortable with self-hosting.

- LedgerSMB — Open source accounting and ERP focused on accounting-first workflows and regulatory compliance.

- Tryton — Modular, open source business application platform that includes accounting, invoicing, and financial reports for technical users.

When choosing an alternative, evaluate integration ecosystems, payroll availability in your region, and whether you prefer cloud-hosted SaaS or a self-hosted open source solution.

Frequently asked questions about ZipBooks

What is ZipBooks used for?

ZipBooks is used for cloud accounting, invoicing, expense tracking, and basic financial reporting. Small businesses and freelancers use it to create invoices, accept payments, reconcile bank transactions, track time, and generate profit & loss and balance sheet reports for tax and management purposes.

Does ZipBooks integrate with payment processors?

Yes, ZipBooks integrates with common payment processors to accept card and ACH payments. Integration allows invoices to include a payment link and supports automated reconciliation of payments against invoices; processor fees are charged separately by the payment provider.

How much does ZipBooks cost per user?

ZipBooks starts at $0/month for the Free Plan. Paid plans generally begin around $15/month for Starter features and go to roughly $35/month for Professional features; Enterprise pricing is custom based on needs.

Can I import bank transactions into ZipBooks?

Yes, ZipBooks supports importing bank transactions via automatic bank feeds and CSV uploads. Automatic connections simplify reconciliation and allow the system to suggest categories; CSV imports are available for banks that require manual export.

Is ZipBooks suitable for accountants and bookkeeping firms?

Yes, ZipBooks can be used by accountants for small-business clients, particularly those who manage multiple small clients and need straightforward reporting and exportable data. Firms with complex client requirements should confirm feature coverage and multi-client workflows during a trial.

Does ZipBooks support payroll?

ZipBooks does not include comprehensive payroll in all plans; it offers payroll through third-party integrations in many regions. Businesses needing in-house payroll should evaluate integrated payroll partners or export data to a payroll provider as part of the workflow.

Can I connect ZipBooks to my e-commerce store?

Yes, ZipBooks can integrate with e-commerce platforms through native connectors or middleware tools. Integrations sync sales, refunds, and fees to accounting records; for platforms without direct connectors, use the API or CSV exports to reconcile sales.

How secure is data in ZipBooks?

ZipBooks uses standard cloud security practices including encrypted connections and data backups. For specifics on encryption, compliance, and SOC/ISO certifications consult ZipBooks’ security documentation and data protection policies.

Does ZipBooks offer multi-currency support?

ZipBooks supports basic multi-currency invoicing in higher-tier plans or via integrations. If you bill customers in multiple currencies frequently, verify exchange rate handling, reporting, and local tax treatment during the trial or with sales support.

Can I export my data from ZipBooks?

Yes, ZipBooks provides export options for transactions, invoices, and reports in CSV or common accounting formats. Exports let you hand off records to external accountants or migrate to other accounting systems when needed.

ZipBooks careers

ZipBooks hires across product, engineering, customer success, and sales roles focused on small-business accounting workflows. Teams typically include product managers experienced in SMB accounting needs, backend engineers working on secure banking integrations, and customer success specialists who guide onboarding and bookkeeping practices.

Roles at ZipBooks emphasize domain knowledge in accounting and strong customer orientation. Candidates with experience in fintech, payments, or B2B SaaS often find a close match to the company’s product priorities. Interview processes commonly include technical assessments for engineering roles and case-based exercises for customer-facing positions.

Compensation and benefits vary by role and location; ZipBooks has previously offered flexible work arrangements and focused on building remote-friendly teams. Interested candidates should consult ZipBooks’ official careers page for current openings, hiring locations, and application instructions.

ZipBooks affiliate

ZipBooks offers partnership and affiliate programs for accountants, bookkeepers, and software resellers who recommend the platform to clients. Affiliates typically receive referral payouts, partner discounts, or co-marketing support depending on the program tier and lead volume.

Affiliate arrangements often include resources like onboarding guides, partner training, and a partner portal to track referrals. Accountants who integrate ZipBooks into their service offering can benefit from streamlined client bookkeeping and simple client access management.

For partner terms, commission structures, and program applications, view ZipBooks’ partner and affiliate information on their website or contact sales for partnership details.

Where to find ZipBooks reviews

Independent user reviews for ZipBooks are available on software review sites, industry blogs, and marketplaces that collect user feedback. Look for reviews that reference specific use cases similar to yours—such as freelancer invoicing, agency project billing, or small retail bookkeeping—to get relevant perspective.

Popular review sources include business software directories and technology review platforms where users rate ease of use, customer support, feature completeness, and pricing. Also check community forums and accounting professional groups for practical insights about workflows, integrations, and real-world limitations.

For the most current information on features, security, and pricing, review ZipBooks’ official documentation and pricing pages: view ZipBooks’ features overview and check ZipBooks’ current pricing tiers.